* Should further information be required, please refer to the attached joint statement.

Joint Statement of the 27thASEAN+3

Finance Ministers’ and Central Bank Governors’ Meeting

Tbilisi, Georgia, 3 May 2024

Ⅰ. Introduction

1. The 27th ASEAN+3 Finance Ministers’ and Central Bank Governors’ Meeting (AFMGM+3) was convened on 3 May 2024u nder the co-chairmanship of H.E. Santiphab Phomvihane, Minister of Finance of the Lao People’s Democratic Republic, H.E. Bounleua Sinxayvoravong, Governor of the Bank of the Lao People’s Democratic Republic, H.E. Choi Sang-Mok, Minister of Finance of the Republic of Korea, and H.E. Rhee Changyong, Governor of the Bank of Korea. The meeting took place in Tbilisi, Georgia. The Director of the ASEAN+3 Macroeconomic Research Office (AMRO), the President of the Asian Development Bank (ADB), the Deputy Secretary-General of ASEAN Secretariat, and the Deputy Managing Director of the International Monetary Fund (IMF) were also present at the meeting.

2. We exchanged views on current developments and the outlook for the global and regional economies, as well as policy responses to risks and challenges. We recognize that the ASEAN+3 financial cooperation forum is playing an increasingly essential role in supporting regional economies to address the risks and challenges. In this regard, we agree to strengthen regional financial cooperation, including through the Regional Financing Arrangement (RFA) Future Direction / Chiang Mai Initiative Multilateralisation (CMIM), AMRO, Asian Bond Markets Initiative (ABMI), Disaster Risk Financing (DRF), and ASEAN+3 Future Initiatives.

Ⅱ. Regional Economic Development and Outlook

3. The ASEAN+3 region registered stronger growth of 4.3 percent in 2023, an increase from 3.2 percent in 2022, driven by robust domestic demand amid weak external demand. Inflation in the region moderated, although core inflation remained elevated in some economies. Financial conditions improved toward the end of the year, with credit growth remaining firm and equity markets recovering.

4. The ASEAN+3 region is expected to grow at a faster pace of 4.5 percent in 2024, before moderating to 4.2 percent in 2025. We expect domestic demand to remain resilient, underpinned by recovering investment and firm consumer spending. Export recovery, driven by global semiconductor upcycle, robust consumer spending on goods in major economies, continued tourism recovery, and sustained demand for modern services should provide additional lift to growth. In the medium term, we expect the ASEAN+3 region to continue to be an engine of growth in the global economy, growing faster than the world average and contributing around 45 percent of global growth in 2024–2030. Inflation is forecast to continue moderating but disinflation would be gradual, especially with core inflation, as domestic demand remains robust. Risks could affect ASEAN+3 prospects in the near term, including geopolitical tensions, a spike in global commodity prices and transportation costs, and a slowdown in the growth of major trading partners, as well as heightened foreign exchange market volatility driven by negative spillovers from external factors; in the medium to long term, these risks could include climate change and aging population.

5. We agreed that the positive outlook for ASEAN+3 provides an opportunity for the region to rebuild policy space lost during the pandemic. The priority for fiscal policy across the region is to restore fiscal buffers and strengthen fiscal sustainability while providing targeted support for the economy. We view that monetary policy should remain relatively tight as necessary in many member economies to ensure inflation expectations are firmly anchored in view of the continued upside risks to inflation. Structural reforms and increasing investment in productivity- and resilience-enhancing sectors would be crucial to unlock growth potential and meet the structural challenges ahead. We acknowledge the merits of collaborating towards a strong and inclusive recovery and making continued progress in the 2030 Agenda for Sustainable Development, in order to achieve stronger, greener, more resilient, and better balanced global development. We reaffirm our strong commitment to the open, free, fair, inclusive, equitable, transparent, and non-discriminatory rules-based multilateral trading system with the World Trade Organization (WTO) at its core, and fully support the implementation of the Regional Comprehensive Economic Partnership (RCEP) Agreement.

Ⅲ. Strengthening Regional Financial Cooperation

Regional Financing Arrangement (RFA) Future Direction

6. Reform of the ASEAN+3 RFA, including the CMIM, represents crucial efforts to reinforce the regional financial safety net. In this regard, we commended the Deputies’ efforts to explore more robust financing structures and to develop new facilities to effectively prevent, mitigate and resolve future crises. We agreed on the benefits of a paid-in capital structure which would enhance the effectiveness of the regional financial safety net while recognizing the costs and challenges including the need for clarity on (a) foreign reserves recognition and (b) governance and the required capabilities for managing such structure. We also discussed various financing structure options, together with their objectives, with the aim of transitioning the CMIM to include a new paid-in capital structure which would further complement the Global Financial Safety Net, based on the study on possible new financing structures. We tasked Deputies, with AMRO’s support, to further analyse the modalities and implications of each paid-in capital structure option1) , and address challenges with the aim of narrowing down financing structure options by 2025.

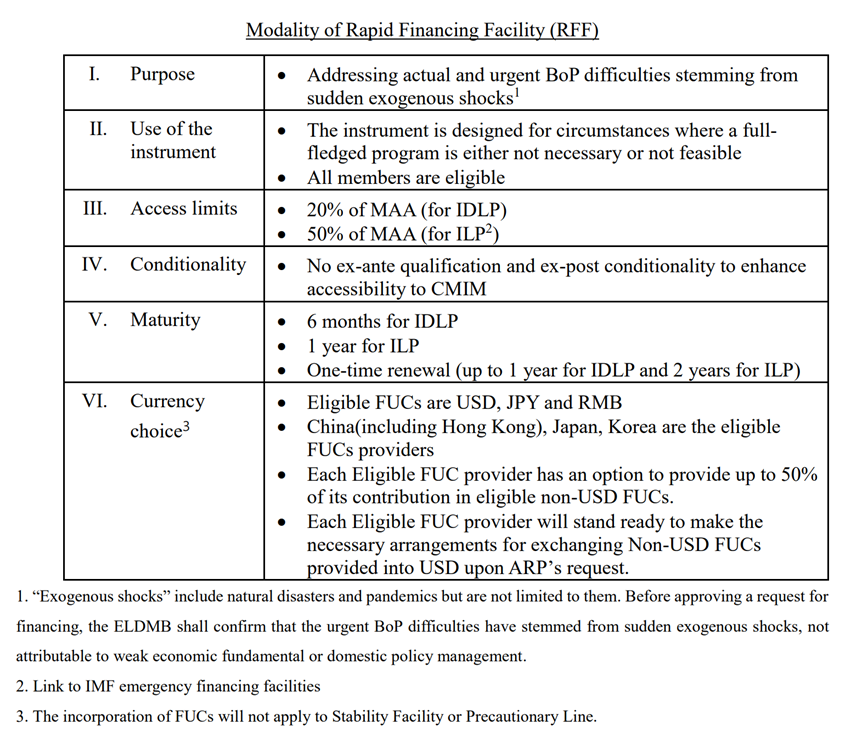

7. We endorsed the establishment of the Rapid Financing Facility (RFF) with the incorporation of eligible freely usable currencies (FUCs) as its currencies of choice, as a new facility under the CMIM, and its modalities (see Annex below). We also endorsed the work plan to approve at our next meeting the amendments to the CMIM Agreement on the RFF with eligible FUCs. We hereby instruct the Deputies to finalize the amendments to the CMIM by the end of 2024. We are confident that the establishment of this new facility under the CMIM will significantly bolster the regional resilience of ASEAN+3. This will be achieved by enabling members to access emergency financing during periods of urgent balance of payments needs, possibly arising from sudden exogenous shocks including pandemics and natural disasters.

8. We also encourage Deputies, with AMRO's support, to further implement the RFA roadmap, including exploring new facilities such as Policy Adjustment Instrument to improve the function of RFA.

Chiang Mai Initiative Multilateralisation (CMIM)

9. We welcomed the adoption of the updated CMIM Operational Guidelines (OG) to reflect the new CMIM margin structure, which would improve CMIM’s accessibility as an effective financing option for members in times of need. We acknowledge the progress in discussions on the review of the CMIM US dollar (USD) reference rate and local currency (LCY) margin structure, which will continue to align CMIM interest rates with global financial market conventions. For the USD component, we acknowledge the Deputies’ endorsement of the continued use of the current CMIM USD reference rate and instruct them to resolve the remaining issue on spread adjustment by the end of 2024. On the use of LCY, we welcome the Deputies’ endorsement to develop a unified margin structure and encourage them to continue to develop a unified LCY margin structure by the end of 2024.

10. We are pleased with the progress made on the 2nd Periodic Review (PR) of the CMIM Agreement. As part of this effort, we welcome the Deputies’ endorsement of the revision of the OG relating to the revamping of the CMIM Precautionary Line (PL),to allow for the renewal of PL drawings possible and finalize the legal amendments to the OG by year end. We encourage the Deputies to continue the discussion on the remaining issues in the 2nd PR, including the review of the IMF de-linked portion(IDLP), with a view to finalizing there view based on revised IDLP readiness indicators by the end of 2024.

11. We also welcome the successful completion of the 14th Test Run conducted in 2023, which tested actual fund transfers of members under the CMIM Stability Facility IDLP. We look forward to the 15th Test Run that will be conducted later this year, which will test the decision-making process of the CMIM PL IDLP in the case of a mixture of local currency and USD being used. We acknowledge the progress made on the opening of LCY accounts, essential for providing LCY for CMIM liquidity support.

ASEAN+3 Macroeconomic Research Office (AMRO)

12. We commend AMRO’s effort in implementing its Strategic Direction 2030 (SD2030), which provides guidance for its strategic planning, operations, and management. We are very pleased to entrust AMRO with providing secretariat support to the ASEAN+3 Finance Process starting from this year. As our regional financial cooperation continues to expand, it is important to have stronger and more dedicated institutional support in both administrative and policy fronts to ensure systematic and professional support for promoting the interests and voice of the ASEAN+3 Finance Process. We welcome AMRO’s new Partnership Strategy (PS2030) and the successful launch of the ASEAN+3 Finance Think-tank Network (AFTN), which promotes the collaborative use of regional resources to support regional macroeconomic and financial resilience and stability. Looking ahead, we expect AMRO’s further efforts in developing the Technical Assistance (TA) Strategy, Digital Development Strategy, and the Communication Strategy, to better align its operations and institutional arrangements with the SD2030.

13. We reaffirm our appreciation of AMRO’s efforts to continuously strengthen its surveillance capacity and welcome the launch of its second flagship report, the ASEAN+3 Financial Stability Report in December 2023. We commend the improvements in AMRO’s research work, with emphasis on the in-depth analyses on thematic topics and timely policy advice to members and encourage AMRO to keep a close eye on emerging risks and challenges given the uncertainties in the global outlook. We value and look forward to AMRO’s intellectual and operational support in our discussions on the CMIM and RFA future direction, which has contributed to the strengthening of our region’s self-help mechanism. We appreciate the continued financial contributions from China, Japan and Korea, which have helped strengthen AMRO’s TA function, as well as ASEAN members’ continued participation in support of AMRO’s TA work.

14. We reiterate the crucial role of accountability in ensuring good governance. To this end, we welcome AMRO’s work plan to review and update its performance evaluation framework in line with its SD2030, and look forward to AMRO’s plans to further enhance its internal governance and organisational risk management by aligning with the best practices of international financial institutions. We welcome the results of the holistic review of AMRO’s senior management governance and look forward to the arrival of the newly established Deputy Director (Functional Surveillance and Research) in July 2024, as well as the review of the handover schedule of AMRO’s senior management.

Asian Bond Markets Initiatives (ABMI)

15. We welcome the progress made under the ABMI Medium-Term Road Map 2023-2026 with support from ADB and commends the Credit Guarantee and Investment Facility (CGIF)'s efforts to expand and innovate the issuance of LCY bonds. We also acknowledge the ABMI's contribution to the issuance of LCY sustainable bonds to create the local market, together with the development of a sustainable finance ecosystem, including the establishment of necessary regulatory frameworks, local verifiers, and sustainability disclosures. We convey our appreciation of ADB for its contributions to date and look forward to further enhancing the development of the ABMI initiative.

Disaster Risk Financing (DRF)

16. We welcome the progress on the Disaster Risk Financing (DRF) after its upgrading as a regular agenda item under the ASEAN+3 finance track, with the support of the World Bank, the Southeast Asia Disaster Risk Insurance Facility (SEADRIF), and the ASEAN Cross-Sectional Coordination Committee on Disaster Risk Financing and Insurance (ACSCC-DRFI). In particular, we welcome the update of the Action Plan of the ASEAN+3 DRF Initiative, noting it as an important platform in strengthening our regional resilience against potential economic and financial losses in future occurrences of disasters. We welcome the establishment of the ASEAN+3 DRF Initiative Secretariat and confirm the agreement to review it in two years. We also welcome Mr. Yoshihiro Kawai as the Secretary General of ASEAN+3 DRF Initiative Secretariat. We support the knowledge exchange program on DRF for Agriculture (DRFA) that aims to strengthen the ASEAN+3 capacity building on DRFA, and to provide a platform for members to share and exchange their countries’ lessons and experiences in DRFA.

ASEAN+3 Future Initiatives

17. We welcome the substantial progress made in deepening and broadening the ASEAN+3 financial cooperation, including those made by the Working Groups (WGs). We welcome WG1’s continuous efforts to deepen the region’s capabilities in adopting innovative financing tools, following the launch of the joint ADB-ASEAN+3 Report on “Reinvigorating Financing Approaches for Sustainable and Resilient Infrastructure in ASEAN+3” last year. This includes the ASEAN Catalytic Green Finance Facility (ACGF) Innovation Finance Clinic on “Green and Resilient Buildings in ASEAN” workshop in Singapore in September 2023 and an upcoming capacity building workshop in Thailand in 1H 2024, organized by the ADB. We acknowledge the progress of WG2 and AMRO’s report on “IMF Policy Coordination Instrument and implications for the ASEAN+3 RFA toolkit”, which serves as a good reference for members to discuss and develop the ASEAN+3 Policy Adjustment Instrument going forward. We welcome WG4’s work on the “Regional Fintech Regulatory Framework”, and the activities and future detailed work plans of the Open Banking System, initiated to enhance financial inclusion through the spread of fintech in the region. We also take note on the ongoing study aimed at identifying risk factors that could trigger digital financial crises and proposing measures for an effective response to transnational digital financial crises. We encourage the WGs to make further progress, with concrete outcomes to deepen our cooperation in these areas.

18. We welcome AMRO’s Policy Position Paper on “ASEAN+3 Household Debt” and “ASEAN+3 Corporate Debt and MSME Debt-at-Risk in a High Interest Rate Environment: From Pandemic to Pandemonium?” We acknowledge AMRO’s critical roles in providing intellectual and technical inputs to support discussions on relevant ASEAN+3 future initiatives, and in identifying and assessing risks to the region’s financial stability in the post-pandemic era. With the support from ADB, we also welcome the report on “Key Policies of Ministries of Finance to Mobilize Sustainable Finance”. The report highlights the fiscal policy gap on sustainable finance and explores options to fill the policy gap in member countries. We likewise welcome AMRO’s Policy Position Paper on “Promoting Local Currency Transactions in ASEAN+3 Cross Border Payments”, which provides a valuable reference for members on ways to strengthen and enhance cooperation on payment connectivity to facilitate the expansion of local currency use in international transactions.

Ⅳ. Conclusion

19. We express our appreciation to the authorities of the Lao People’s Democratic Republic and the Republic of Korea for their excellent arrangements as the Co-chairs of the ASEAN+3 Finance Ministers’ and Central Bank Governors’ Process in 2024. We agreed to meet in Milan, Italy in 2025, and look forward to working with Malaysia and China as the Co-chairs of the ASEAN+3 Finance Ministers’ and Central Bank Governors’ Process in 2025.

Please refer to the attached files.