-

01

-

02

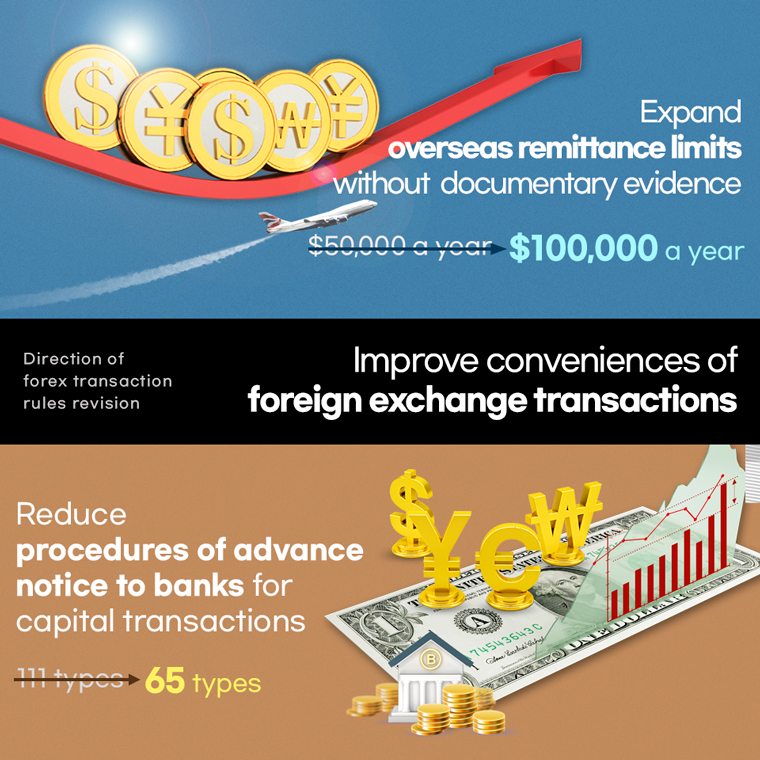

Direction of forex transaction rules revision

Improve conveniences of foreign exchange transactions

Expand overseas remittance limits without documentary evidence

$50,000 a year→ $100,000 a yearReduce procedures of advance notice to banks for capital transactions

111 types→ 65 types -

03

Direction of forex transaction rules revision

Resolve inconveniences in foreign currency borrowing and overseas investment

Ease reporting requirements for large-scale foreign currency borrowing

$30 million a year→ $50 million a yearAbolish the requirement of frequent reporting and simplify regular reporting for foreign direct investment

-

04

Direction of forex transaction rules revision

Build the competitiveness of forex transaction services

Expand approvals for more securities firms to engage in the currency exchange business

Mega investment banks (4 firms)→ Large secturities firms (9 firms)

Reform of Foreign Exchange Transaction Rules