-

01

-

02

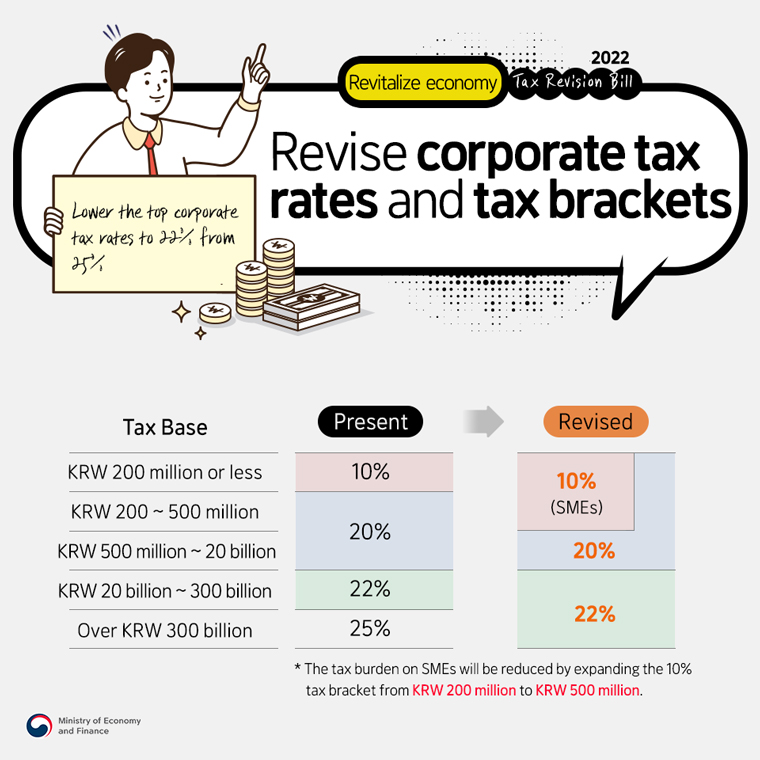

Revitalize economy, Revise corporate tax rates and tax brackets

The tax burden on SMEs will be reduced by expanding the 10% tax bracket from KRW 200 million to KRW 500 million.

-

03

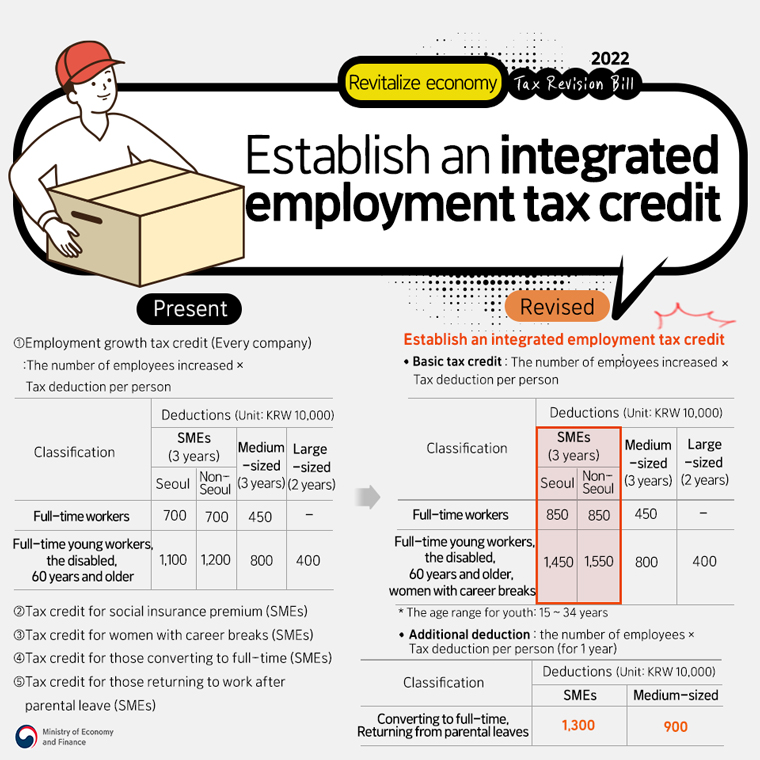

Revitalize economy, Establish an integrated employment tax credit

-

04

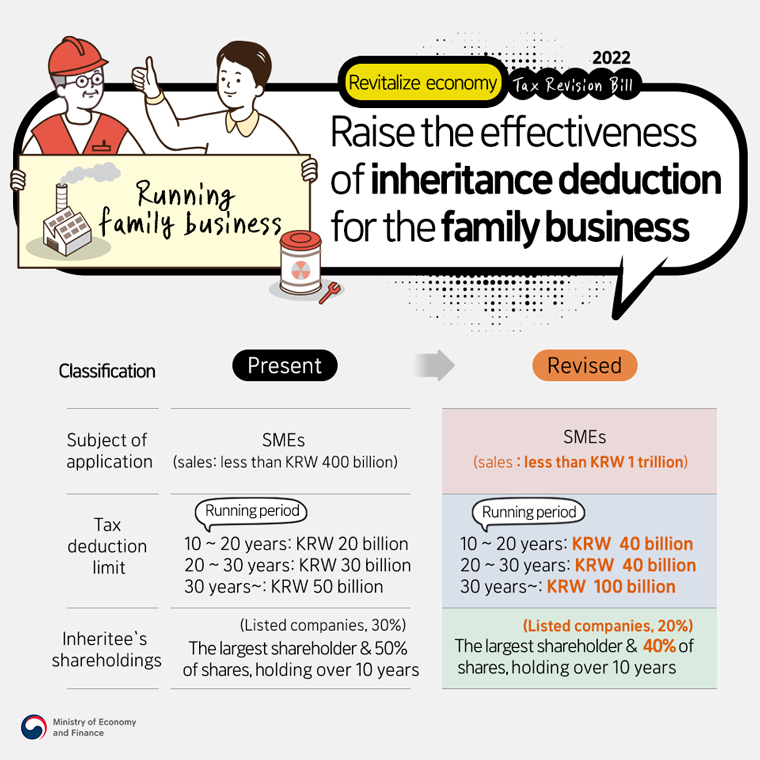

Revitalize economy, Raise the effectiveness of inheritance deducation for the family business

-

05

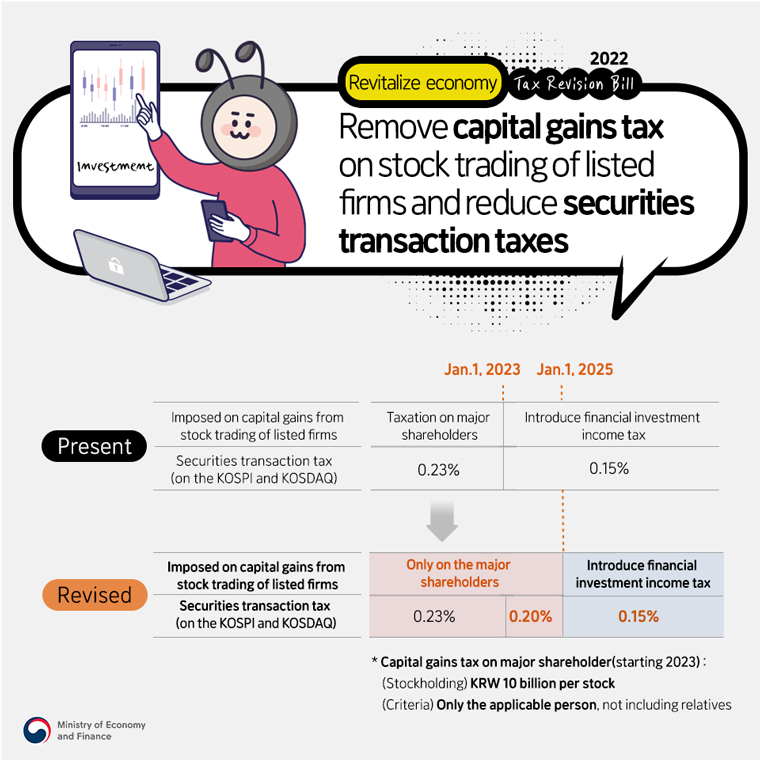

Revitalize economy, Remove capital gains tax on stock trading of listed firms and reduce securities transction taxes

-

06

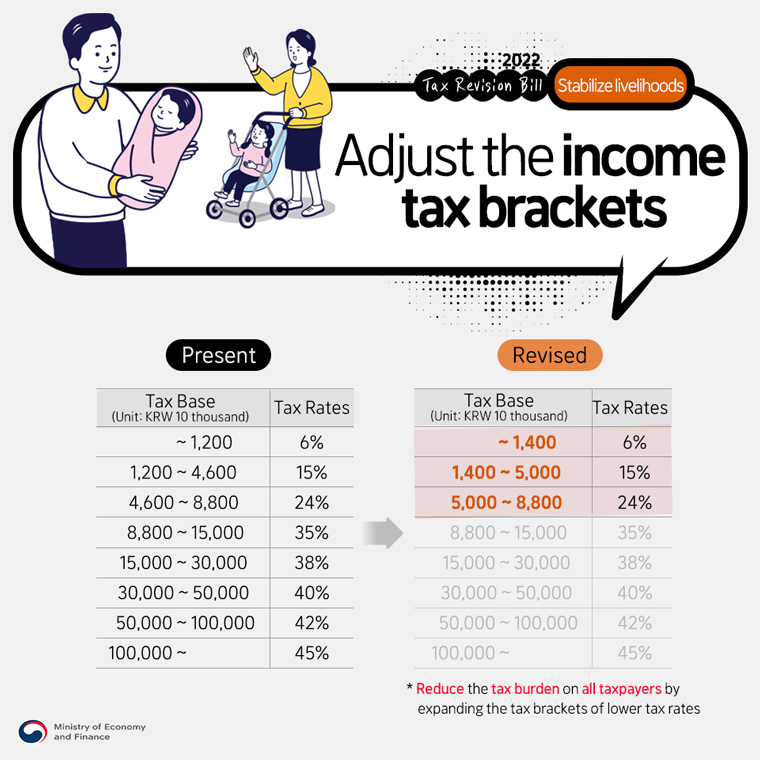

Stabilize livelihoods, Adjust the income tax brackets

Reduce the tax burden on all taxpayers by expanding the tax brackets of lower tax rates

-

07

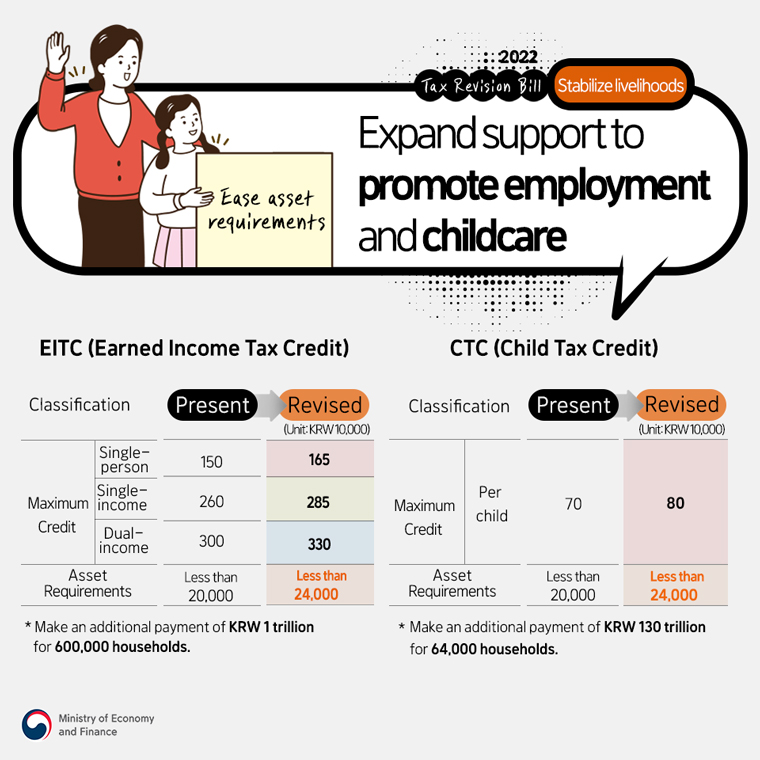

Stabilize livelihoods, Expand support to promote employment and childcare

EITC(Earned Income Tax Credit), Make and additional payment of KRW 1 trillion for 600,000 households.

CTC(Child Tax Credit), Make an additional payment of KRW 130 trillion for 64,000 households.

-

08

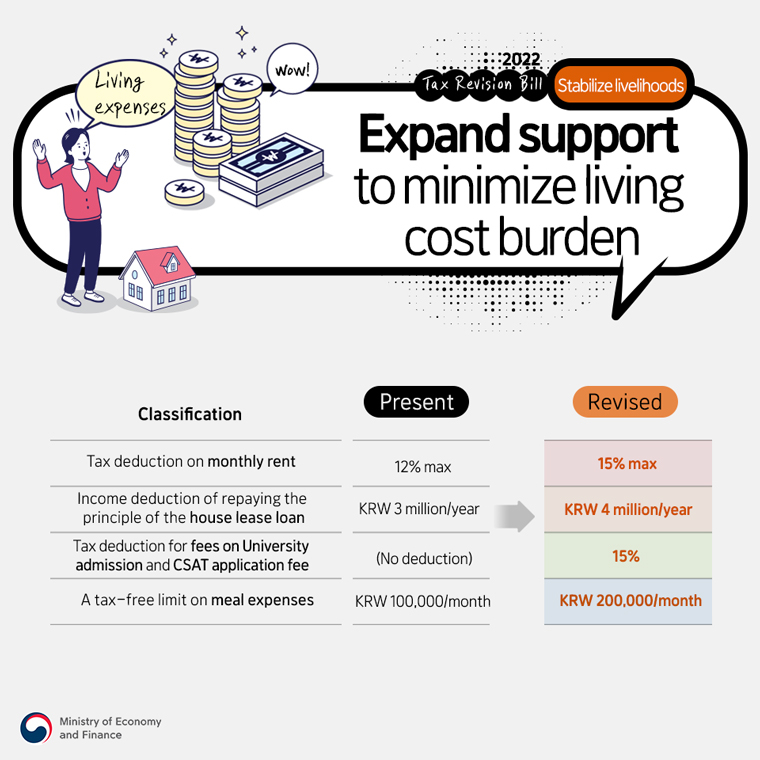

Stabilize livelihoods, Expand support to minimize living cost burden

-

09

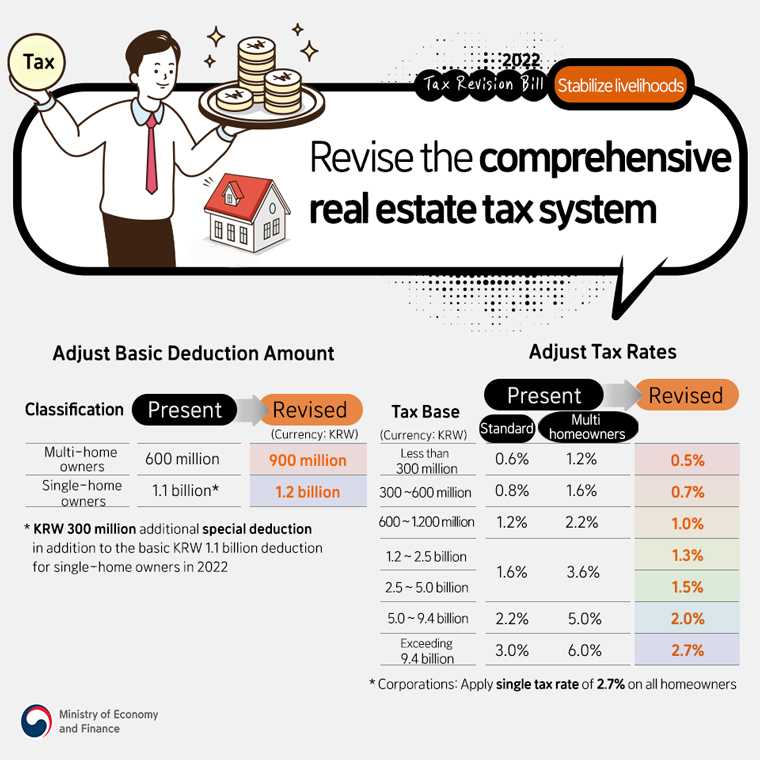

Stabilize livelihoods, Revise the comprehensive real estate tax system

Adjust Basic Deduction Amount, KRW 300 million additional special deduction in addition to the basic KRW 1.1 billion dedction for single-home owners in 2022

Adjust Tax Rates, Corporations : Apply single tax rate of 2.7% on all homeowners

-

10

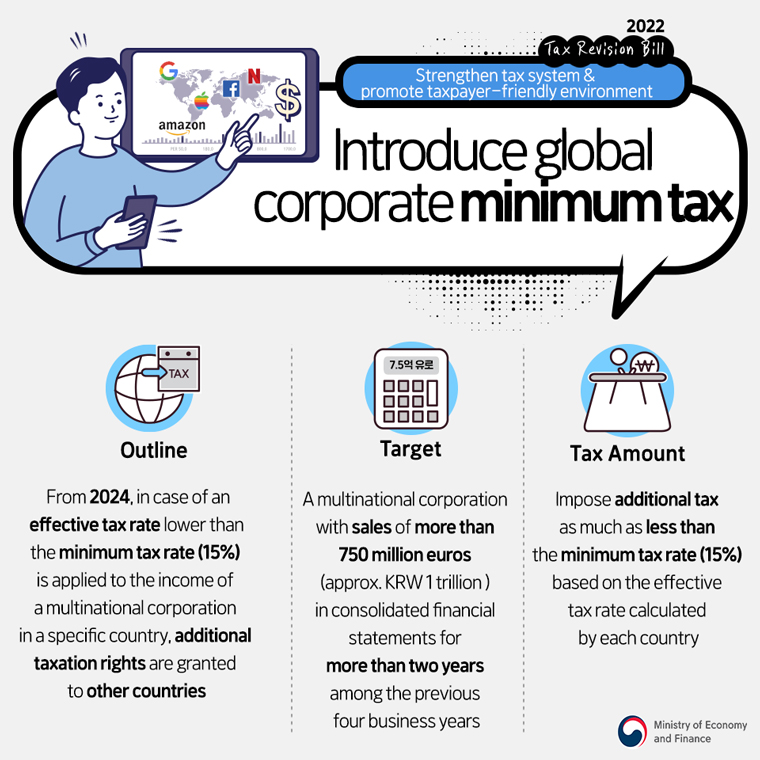

Strengthen tax system&promote taxpayer-friendly environment, Introduce global corporate minimum tax

Outline : From 2024, in case of an effective tax rate lower than the minimum tax rate(15%) is applied to the income of a multinational corporation in a specific country, additional taxation rights are granted to other countries

Target : A multinational corporation with sales of more than 750 million euros(approx. KRW 1 trillion) in consolidated financial statements for more than two years among the previous four business years

Tax Amount : Impose additional tax as much as less than the minimum tax rate(15%) based on the effective tax rate calculated by each country

-

11

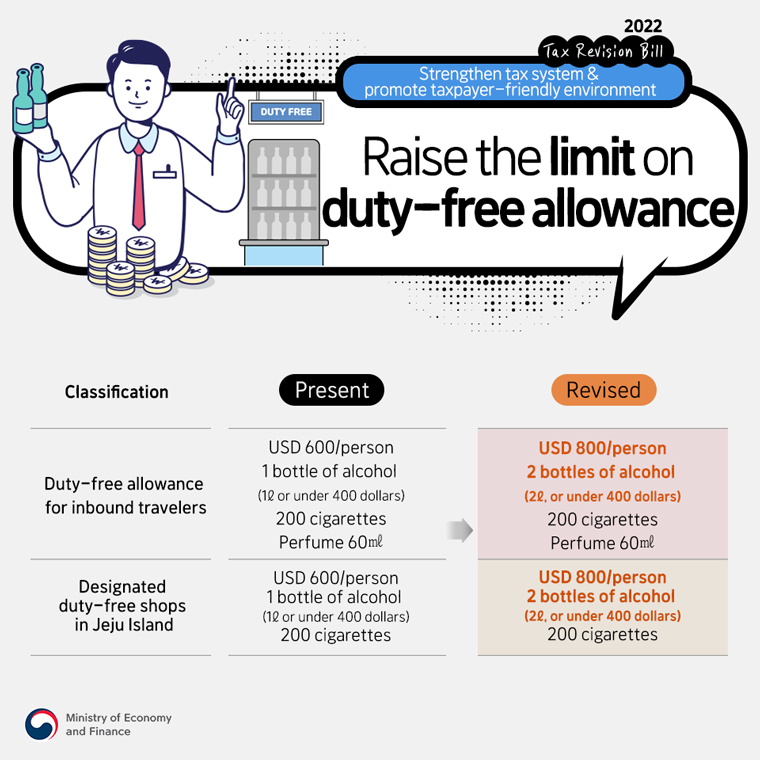

Strengthen tax system&promote taxpayer-friendly environment, Raise the limit on duty-free allowance

-

12

2022 Tax Revision Bill, Build a virtuous cycle of the economy through dynamic and innovative growth

Tax Revision

2022 Tax Revision Bill