The Korean economy is expected to continue to recover owing to the gradually improving global economy and government policies to improve the domestic economy. The Korean economy is forecast to grow 2.7 percent in 2013 and 3.9 percent in 2014.* However, potential anxiety factors, such as increased financial market volatility due to tapering quantitative easing and the possibility of a slowdown in the growth rate of emerging economies, pose a risk to the Korean economy.

∗ Average 2014 growth rate forecast of major institutions: 3.8-3.9% (OECD, BOK, investment banks, among others)

The outlook for tax revenues continues to be poor due to the economic slowdown, and expenditures will continue to increase as welfare costs continue to rise and the central government continues to provide support to local governments. It is necessary for the government to stimulate the economy by promoting job creation, stimulating investment while maintaining fiscal expenditures at a reasonable level in order to strengthen the economic recovery.

The government will take care of its responsibilities by strategically managing public finances while at the same time taking into account the need to expand middle to long-term fiscal space to prepare for future risks.

The 2014 budget proposal bears in mind the current troublesome tax revenue conditions, emphasizing the role public finance plays in stimulating the economy without hampering Korea’s strong fiscal position.

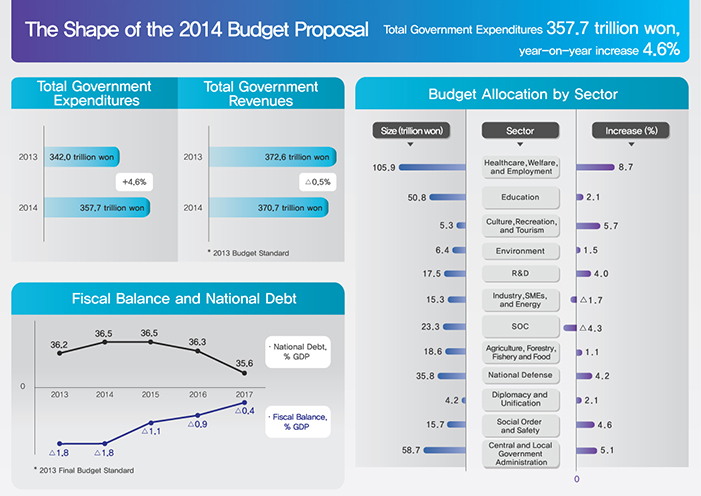

Total government revenues are expected to drop to 370.7 trillion won, a 0.5 percent decrease from the original 2013 budget, due to a decrease in nontax receipts and a slowdown in the growth rate of national tax revenue. Total government expenditures will rise to 357.7 trillion won, an increase of 4.6 percent compared to the original 2013 budget, in order to promote economic recovery. The government will support the economic recovery by making the most of the increase in total government expenditures in 2014, while holding the deficit in the fiscal balance in line with the 2013 budget.

The fiscal balance as a percentage of GDP is expected to post a deficit of 1.8 percent, the same level as the 2013 final budget. National debt as a percentage of GDP is expected to marginally rise compared to the 2013 final budget due to the poor tax revenue situation

∗ National debt (%GDP, 2012): OECD average 108.8, USA 106.3, Japan 219.1, Germany 89.2, UK 103.9

Fiscal soundness will gradually improve over the middle to long-term. The fiscal balance will improve due to increased tax revenues, and a decrease in the growth rate of total government expenditures. The government will promote maintaining a strong fiscal position: tax expenditures will be reduced and the tax base will be widened, fiscal management systems will be tightened, and fiscal risk management systems will be improved.

The fiscal deficit will be reduced to just 0.4 percent in 2017, and national debt will stabilize in the 30percent range (35.6% GDP in 2017).

The government will tighten its middle to long-term fiscal principles. The growth rate of total government expenditures (3.5%) will be maintained at 1.5 percentage points below the growth rate of total government revenues (5.0%).

∗ Growth rate of total government expenditures (%): (2011-2015) 4.8, (2012-2016) 4.6, (2013-2017) 3.5

The government will review ‘Paygo’* related legislation.

∗ Paygo is a system where any increases in mandatory spending or any costs incurred as a result of legislation are offset by other spending cuts or tax increases

Self-evaluations and in-depth evaluations for fiscal projects will be expanded, and fiscal evaluations for the majority of public institutions will be combined.

The government will work to decrease public sector expenditures, such as government operating costs, travel expenses, and event costs, and eliminate waste through long-lasting fiscal reforms by revising current legislation. The tax base will be broadened by modifying tax exemptions and deductions, and by legalizing the underground economy.

The government will strengthen its analysis and management of potential fiscal risk factors, such as public sector debt. The government will accurately calculate and manage all public sector debt(central government, local government and public enterprises) by 2014, and will also determine the long-term fiscal outlook and construct fiscal risk monitoring systems.